With the Fed’s recent interest rate cuts signaling a slowdown in mortgage rates, demand for homebuyers is starting to recover, according to the latest report by the real estate industry. online Redfin (RDFN). The company reported a 9% month-over-month increase in its Homebuyer Demand Index. However, sales have not returned to pre-epidemic levels, and the future is uncertain. Redfin experienced a significant drop in revenue and earnings as rising interest rates caused the housing market to collapse.

While the company’s recent quarterly results were above expectations, it is far from a recovery. The stock has risen over 73% in the last 90 days, mainly in response to the changing environment. Investors interested in exposure to the housing market may want to look at RDFN for some signs of positive results before making a move on the stock.

Redfin Grapples with ten-year-low real estate sales

Redfin Corporation uses technology to provide real estate services, such as buying and selling real estate, title and real estate services. , and mortgage origination and sales. Its online presence is also used for home inspections, loan applications, and title services. The company currently has more than 100 markets.

The latest Redfin report shows a sharp decline in US home prices in the first eight months of 2024, the lowest in ten years, with only 25 out of every 1,000 homes sold . These data show a reduction of 37.5% compared to the 2021 disease sales period and 31% less than the disease year of 2019.

Reasons for this decline include rising mortgage rates, which discourage homeowners from selling due to rising home prices, and low supply of rental housing. The economic and political uncertainty associated with the US presidential election has led to wait-and-see.

Analysis of Redfin’s Recent Financial Results and Outlook

The company recently reported results for Q2 2024. Revenue was $295.20 million, a 7% year-over-year increase, beating analysts’ expectations of $291.39 million. Profit also increased by 9% to $109.6 million. On the downside, the real estate services company’s profit saw a 4% drop from a year ago, to $53.7 million, and its net profit fell to 29% compared to 31% in Q2 2023.

Redfin reported a net loss of $27.9 million, up from $27.4 million last year. However, the Adjusted EBITDA showed an improvement from the loss of $ 6.9 million in Q2 2023 in a measure of this quarter. CEO Glenn Kelman attributes the profit growth to strategic and operational changes and has a positive outlook for the company’s financial health. The company reported earnings per share (EPS) of -$0.23, beating analysts’ estimates of -$0.26.

Following the results of the second quarter, RDFN management has issued guidance for Q3 2024. Revenues are expected to be between $273 million and $285 million, according to with annual growth of 1% to 6%. However, the company expects a net loss of between $30 million and $22 million, which is more than the $19 million loss in Q3 2023. Adjusted EBITDA is calculated it falls between $ 4 million and $ 12 million.

What is the price range for RDFN Stock?

The stock has declined steadily since its peak in 2021, down 77% over the past three years. However, the recent jump in share prices, apparently fueled by Fed rate activity, has breathed much demand into the stock. It trades in the upper half of its 52-week price range of $4.26 – $15.29 and indicates a bullish trend, trading above its 50-day (10.28) moving average. The P/S ratio of 1.3xo sits below the Real Estate Services average of 1.8x, indicating stock trades at a discount. young to business generation.

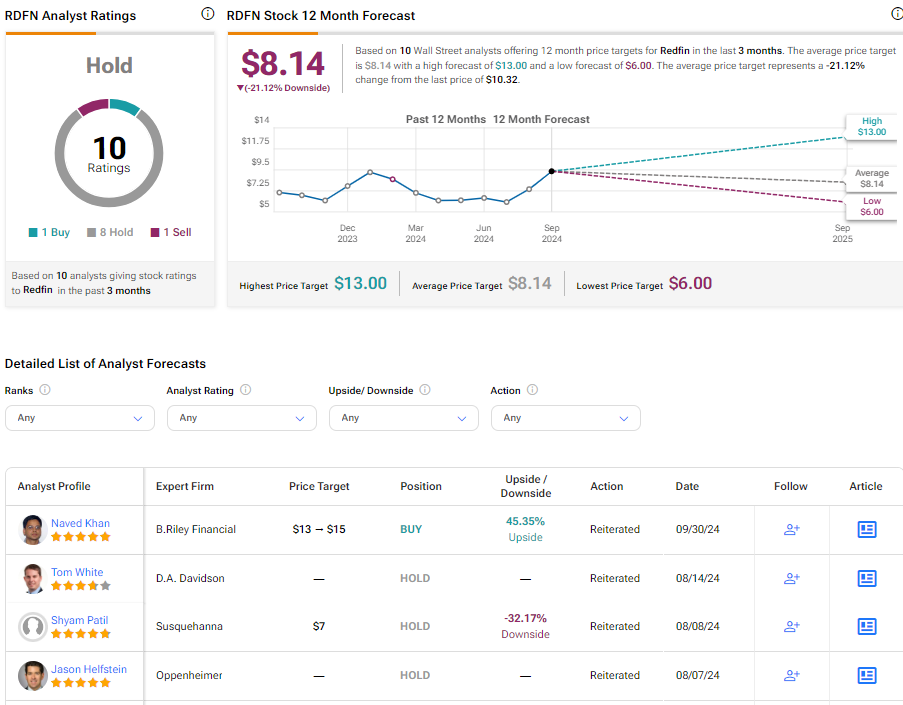

Analysts covering the company are mostly waiting and seeing the RDFN stock. Based on the reviewers’ ten combined criteria, Redfin has rated Persistence. RDFN’s current price target is $8.14, representing a -21.12% decrease from current levels.

See more reviews by RDFN researchers

RDFN in Review

Redfin is showing signs of recovery amid housing market turmoil, spurred by the Fed’s recent interest rate cuts. Although the company’s performance is below the pre-epidemic, it has experienced a remarkable increase in its sales. However, housing prices are at a 10-year low, with economic and political uncertainty. The company’s Q2 2024 financial statements show positive steps, exceeding analysts’ expectations, but the company still recorded a loss.

With signs of growth on the real estate market, investors may want to watch RDFN for potential opportunities. However, a cautious approach is recommended, as the company expects more losses in Q3 2024.

Notice

#Redfin #RDFN #Announces #Record #Profits #Real #Estate #Pulling #TipRanks.com